36 / ’southern

PHILANTHROPY

The IRA Rollover

Good Tool for a Great Idea

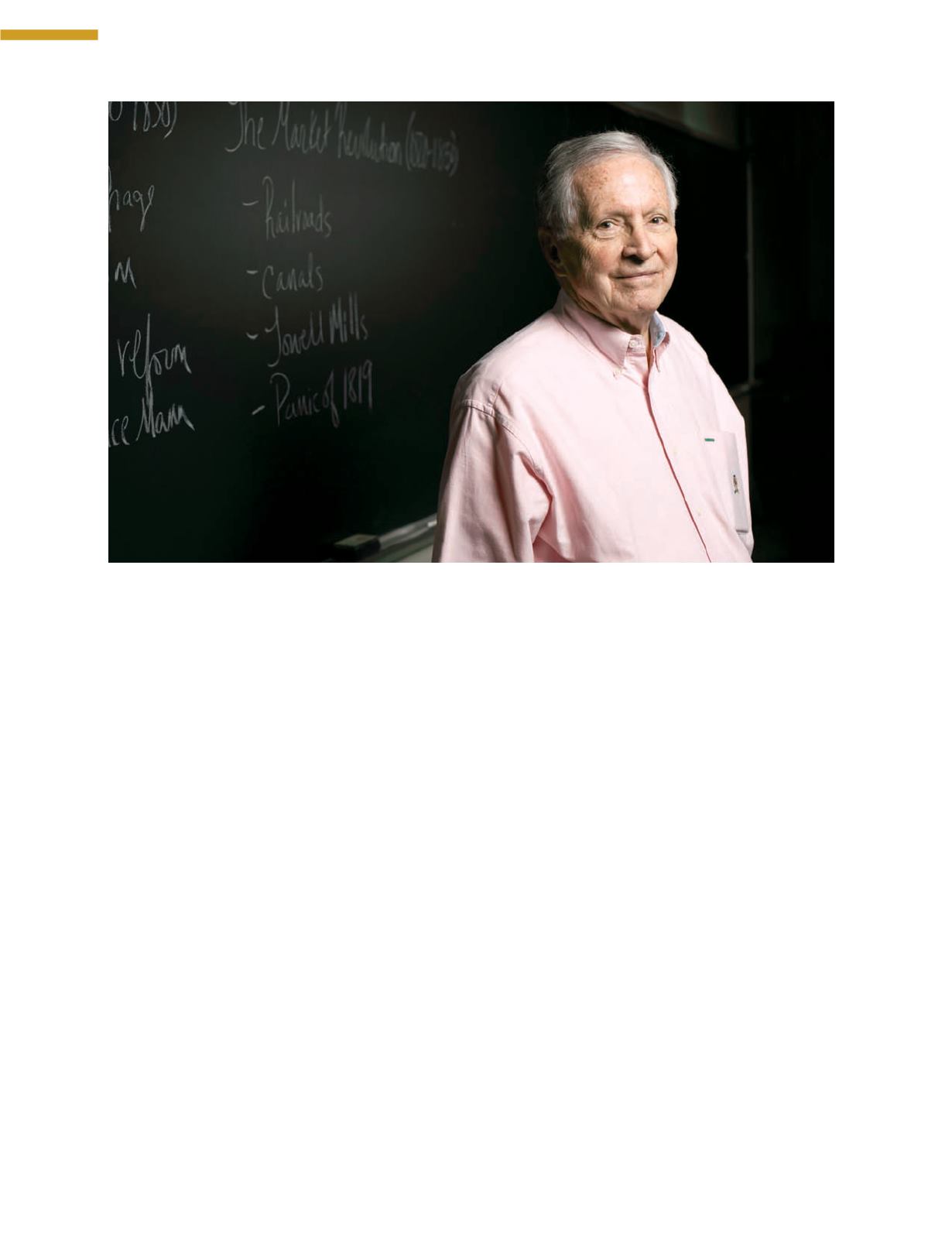

Dr. Bob Whetstone ’55 joined the BSC faculty in 1963 and has been giving back for more than 50 years. Inspired by

Dean Cecil Abernethy’s encouragement and investment in improving his own classroom performance, Whetstone

decided that he wanted to guarantee funds each year to support professional development for promising young faculty.

Making a great idea even better, Whetstone took advantage of a tax law allowing donors who are 70½ or older to

make a direct gift to Birmingham-Southern from their IRAs. That IRA rollover gift endowed the Bob Whetstone Faculty

Development Award and ensured that the award will continue in perpetuity. (For more on this year’s Whetstone Award

winner, see page 9.)

•

What is an IRA rollover gift?

As part of the fiscal cliff law, Congress reauthorized the IRA rollover for 2013. Anyone 70½ or older can make a

charitable gift of up to $100,000 from an IRA. Your gift will qualify for your 2013 required minimum distribution, and

you will not have to pay federal income tax on the amount given to BSC from your IRA.

•

How do you make an IRA rollover gift to BSC?

Simply contact your custodian and choose an amount to be directly transferred to BSC. Your gift could be $1,000,

$10,000, $50,000, or even $100,000. You may want to support the Annual Fund, scholarships, faculty salaries, or the

library. Or, like Bob Whetstone, you might already have a great idea that needs funding! An IRA rollover is an easy and

effective way to make a significant gift to BSC.

•

Questions?

Contact Martha Hamrick Boshers, assistant vice president for institutional advancement at (205) 226-4978 or

Whetstone